IRS considers allowing retirement funds to be used for student debt and medical expenses

BUSINESS

30-10-2024

Photo web

Publicado: 30-10-2024 10:05:41 PDT

Actualizado: 30-10-2024 10:06:38 PDT

A preliminary trial has been conducted with one company.

A U.S. company has received authorization from the Internal Revenue Service (IRS) allowing its employees to choose how to use the company's contributions to their 401(k) retirement accounts. This new option enables employees to allocate these funds toward student debt repayment or health reimbursement accounts, in addition to the traditional retirement savings.

This change, approved in August through a private IRS letter, is seen as a preliminary trial that could pave the way for more companies to offer similar flexibility in the future.

You may also be interested in the Spanish version: IRS evalúa permitir uso de fondos de retiro para pagar deudas estudiantiles y gastos médicos

For employees, this diversified option could serve as a powerful tool to reduce debt and enhance financial stability. However, experts warn of the risks associated with diverting retirement funds, as it reduces the benefits of long-term compounding. In a country where 25% of the population has no retirement savings, a focus on short-term debt relief could jeopardize workers' future financial security.

This model poses a dilemma for those facing immediate debts but aiming to build a solid retirement savings plan.

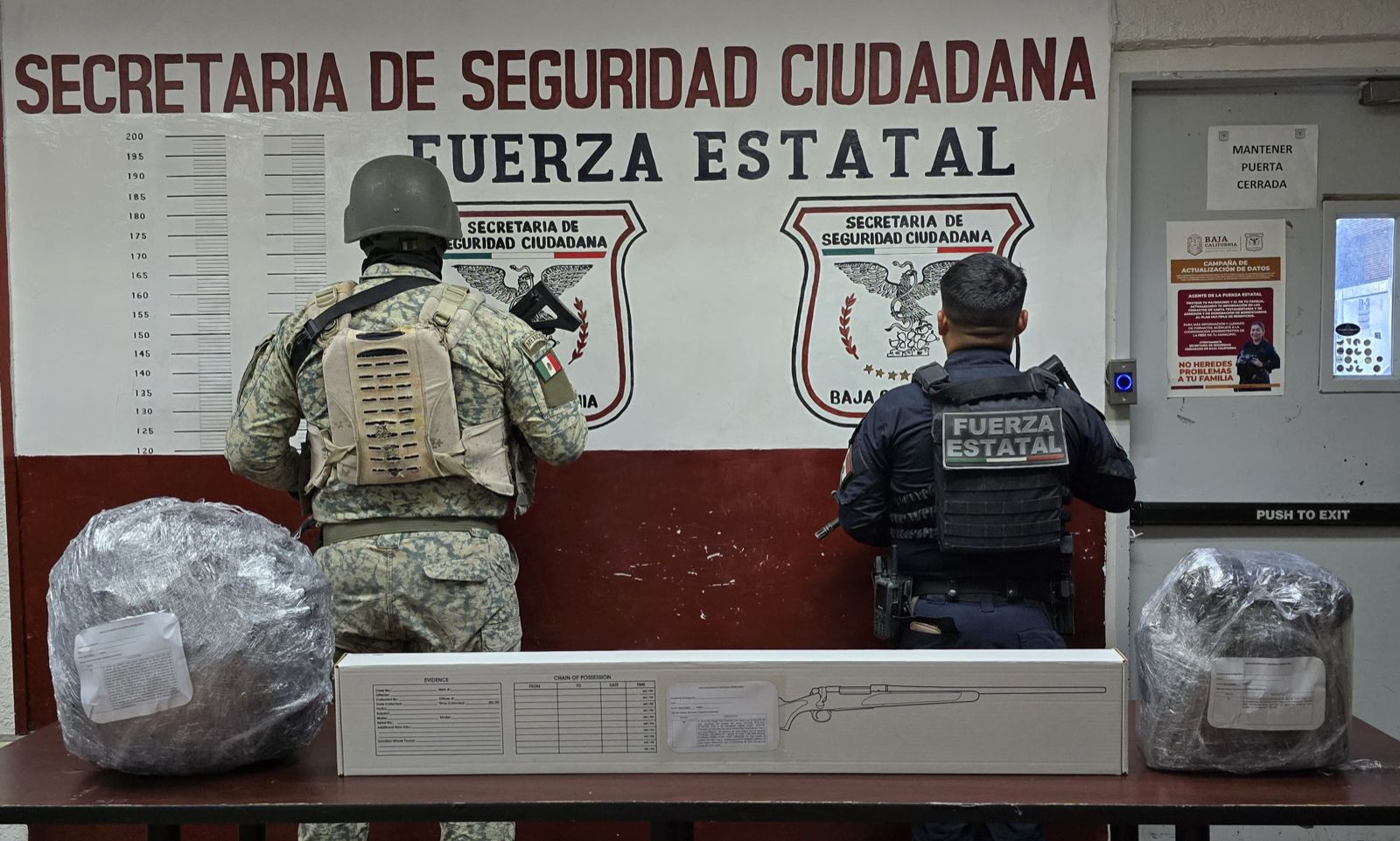

Nacional

hace 1 hora

No hay detenidos en relación a los hechos ..

Ciencia y tecnología

hace 1 hora

La rápida evolución de la inteligencia artificial y las tecnologías cuánticas plantea interrogantes ..

Internacional

hace 1 hora

El expresidente también arremetió contra Jimmy Carter, a quien culpó de entregar el Canal de Panamá ..

Cali - Baja

hace 2 horas

El Secretario de Salud, J. Adrián Medina Amarillas, destacó los efectos negativos de la contaminació ..

Cali - Baja

hace 2 horas

El incidente comenzó en la localidad de Ciudad Coahuila, conocida también como el "Kilómetro 57" en ..

Cali - Baja

hace 3 horas

En un comunicado oficial, el Alcalde Burgueño Ruiz subrayó que su administración no tolerará conduct ..