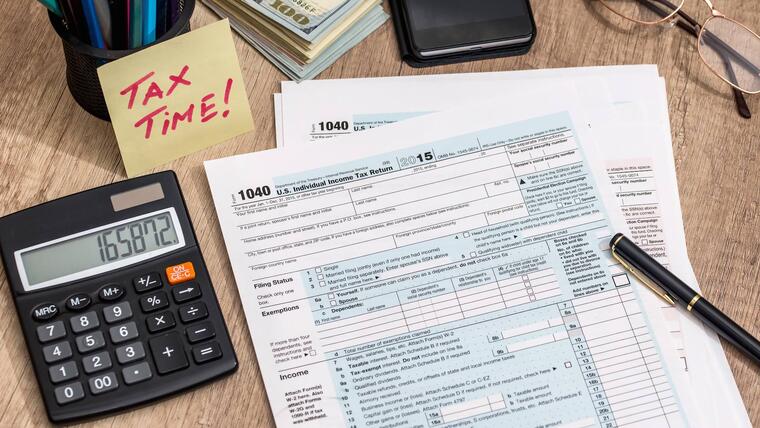

Tax changes and increases to begin in 2025

BUSINESS

22-07-2024

Web

Publicado: 22-07-2024 09:11:32 PDT

Actualizado: 22-07-2024 09:13:19 PDT

Experts claim tax rate changes are coming

At midnight on December 31, 2025, the major provisions of the 2017 Tax Cuts and Jobs Act (TCJA) will expire, resulting in significant tax changes for most Americans. Tax rates will increase, and various credits and deductions will be affected. Tax brackets, the child tax credit, state and local tax deductions, and mortgage interest will change drastically.

The child tax credit will decrease from $2,000 to $1,000 per child under 17 years old if Congress does not act before the end of 2025. Additionally, the refundable portion will be adjusted and will require higher earned income.

Working from home could benefit if the TCJA expires, allowing W-2 employees to once again deduct unreimbursed work-related expenses.

Homebuyers will also be affected: they will be able to deduct mortgage interest on up to $1 million of indebtedness, instead of the current $750,000, which is significant given inflation and high home prices.

Tax experts suggest taking early measures to minimize the impact, such as accelerating income, considering Roth conversions, and adjusting the timing of deductions. Additionally, the expiration of the TCJA will mean the return of itemizing instead of using the standard deduction, increased paycheck withholdings, a reduced child tax credit, and the reappearance of deductions for unreimbursed work expenses and moving expenses.

Furthermore, the alternative minimum tax will affect more people, and the cap on state and local tax deductions will be eliminated. These changes will require planning to avoid tax surprises and potential increases in the budget deficit.

Cali - Baja

hace 50 minutos

Largas filas para entrar al establecimiento se mostraron este domingo ..

Cali - Baja

hace 1 hora

Algunas personas esperan el cruce para hacer compras o pasar tiempo con sus seres queridos ..

Cali - Baja

hace 1 hora

El imputado se encontraba bajo prisión preventiva por los delitos de uso de documentos falsificados ..

Nacional

hace 1 hora

"Nunca los vamos a dejar solos, que aquí está la presidenta, que aquí está su equipo para proteger s ..

Vida y estilo

hace 1 hora

Cada país y región tiene sus propios dulces emblemáticos, y muchos de ellos han cruzado fronteras, c ..

Internacional

hace 2 horas

"No pueden hacerle esto a nuestro país." ..