Renters in Tijuana and US migrants, the losers of the 'super peso'

BUSINESS

16-06-2023

Foto: Web

Publicado: 16-06-2023 16:04:44 PDT

The exchange rate is already around 16.90 at currency exchange houses in Tijuana, although experts estimate that this will not last long

So far this year, the peso has gained 12 percent against the dollar, a situation not seen since 2016. At currency exchange houses, the exchange rate can already be found at 16.90 per unit. This situation brings winners and losers in the Calibaja region, where the economic dynamics are deeply rooted in the exchange rate and the commercial exchange between the communities of both countries.

Even before the COVID-19 pandemic, Tijuana has been facing an influx of reverse migrants, that is, Mexicans with US citizenship who have moved from San Diego and other regions to this city in search of cheaper rents and more affordable basic services.

The fall in the price of the dollar means that those who earn in dollars now have less purchasing power. Although the majority of household rents are irregularly charged in dollars, the rest of the needs such as food, water, gas, fuel, electricity, and entertainment are paid in pesos. US migrants in Mexico and their landlords are the losers in this scenario.

In macroeconomic terms, an exchange rate of around 17 dollars per US currency favors importers, helps in the government management of debt, and assists in containing the increase in prices of imported goods. On the other hand, such a diminished parity with the dollar affects exporters, activities based on foreign currencies such as tourism, and reduces the purchasing power of the thousands of Mexicans who receive remittances year after year.

The clear winners are those who pay rent in dollars but receive income in pesos, a common situation throughout the northern border of Mexico.

According to the financial expert from Monex, the strengthening of the Mexican peso, while controlling inflation and benefiting importers, is also putting pressure on companies that export their products abroad. Carlos González, Director of Analysis at Monex, warned that the Mexican exchange rate has reached its peak and will soon depreciate against the dollar. "A low level in parity does not necessarily imply a recovery, it simply indicates that we will not see further appreciations," González stated for the newspaper El País

Nacional

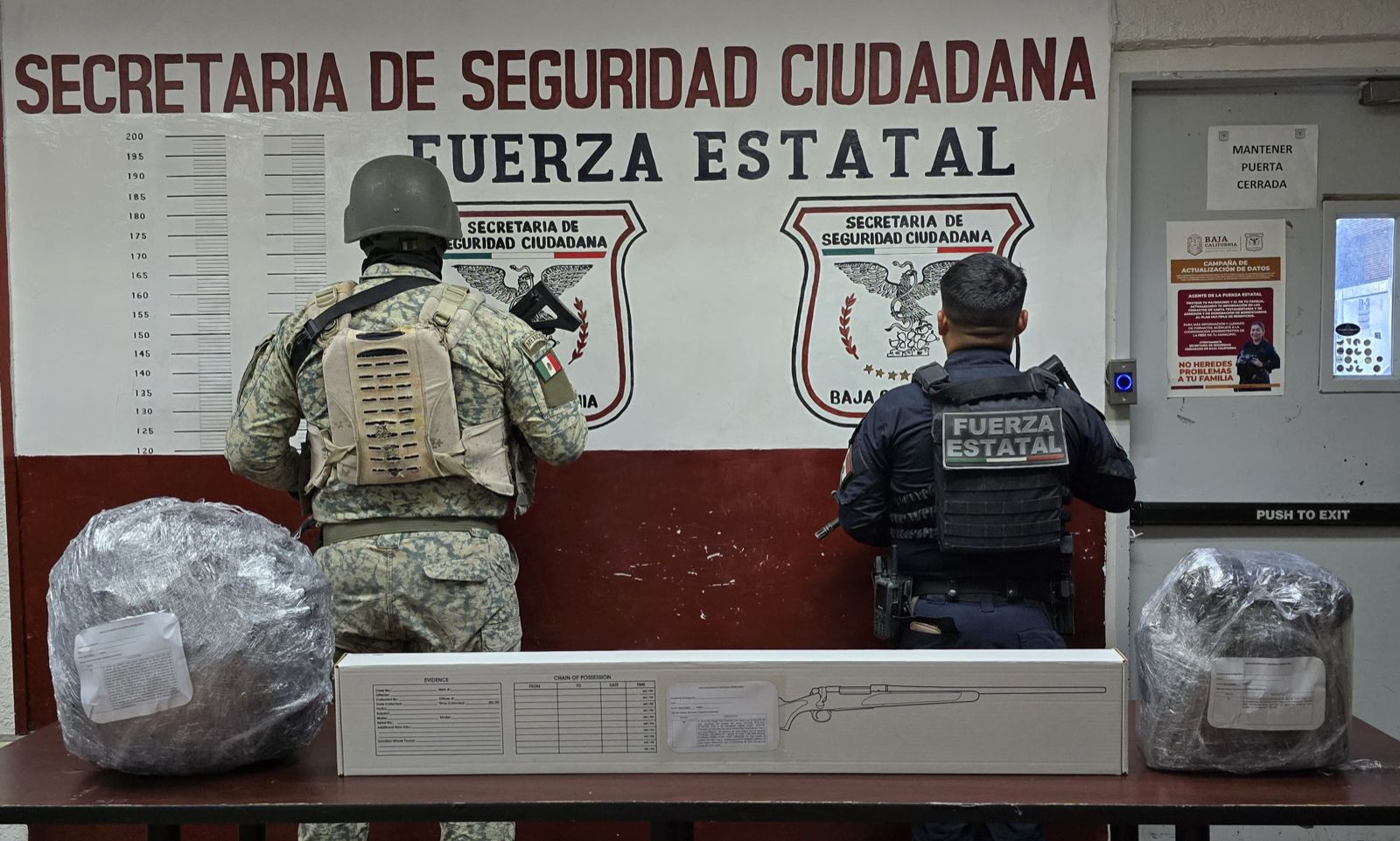

hace 11 horas

No hay detenidos en relación a los hechos ..

Ciencia y tecnología

hace 11 horas

La rápida evolución de la inteligencia artificial y las tecnologías cuánticas plantea interrogantes ..

Internacional

hace 11 horas

El expresidente también arremetió contra Jimmy Carter, a quien culpó de entregar el Canal de Panamá ..

Cali - Baja

hace 11 horas

El Secretario de Salud, J. Adrián Medina Amarillas, destacó los efectos negativos de la contaminació ..

Cali - Baja

hace 11 horas

El incidente comenzó en la localidad de Ciudad Coahuila, conocida también como el "Kilómetro 57" en ..

Cali - Baja

hace 13 horas

En un comunicado oficial, el Alcalde Burgueño Ruiz subrayó que su administración no tolerará conduct ..